11 Feb INFOGRAPHIC: Contract Vs. Full-Time Employees

When it comes to hiring, two types of workers primarily exist – full time employees and independent contracts. Each position has their own benefits and drawbacks from both a worker and employer perspective. For instance, while contractors may make a higher salary, they have to pay higher taxes come April 15th. Consequently, full time employees may not have the work flexibility, but their benefits tend to be far superior. In this blog we’ll talk about the differences between the two positions, and what employers need to look out for prior to hiring one versus the other.

Full Time Employees

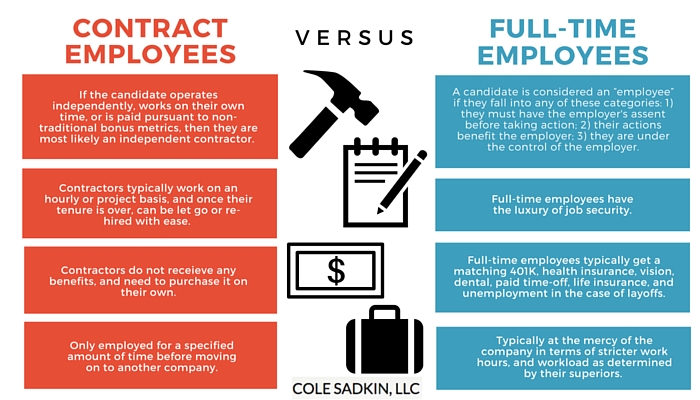

Defining an employee: A candidate is considered an “employee” if they fall into any of these categories: 1) they must have the employer’s assent before taking action; 2) their actions serve the employer; 3) they are under the control of the employer.

Full time employees have the luxury of job security. Bringing on a full time employee means the company is investing heavily in resources by way of training, salary, and benefits. Full time employees typically get a matching 401K, health insurance, vision, dental, paid time off, life insurance, and unemployment in the case of layoffs. All of these add up to additional costs for an employer, which many employees take for granted. While employees gain these added benefits, they are typically at the mercy of the company in terms of stricter work hours, and workload as determined by their superiors.

Independent Contractors

Defining a contractor: If the candidate operates independently, works on their own time, or is paid pursuant to non-traditional bonus metrics, then they are most likely an independent contractor.

If it were possible, many companies would love to strictly hire independent contractors. The reason being, contractors typically work on an hourly or project basis, and once their tenure is over, can be let go or re-hired with ease. Take for instance the oil and gas industry – service companies that drill oil wells like Halliburton tend to outsource much of the work to contractors. Why is this? Mainly because the price of oil fluctuates, and having a very specialized full time employee in a down year could mean they have nothing to do. If a company has a workload that tends to fluctuate or be seasonal, it might make sense to look into contract workers.

Overall, contractors tend to be cheaper even if their rate is higher on an hourly basis. If a company announces massive layoffs, you can be sure that contractors will be the first to go. The reason behind this is simple – the company will not be responsible for their unemployment benefits. From an employee side, contracting can be very attractive because you can have multiple jobs, negotiate to work favorable hours, and depending on the industry, work remotely. Just be careful once tax season comes around – many workers fail to realize that companies tend to cover half of your tax benefits, so you will likely pay a higher rate.

Be Careful with Contractors

In theory, contractors are a great business model – however, the Department of Labor disagrees. The D0L seeks to protect employees across the U.S. – in doing so, they like to see companies have more full time, salaried employees. Companies like Uber and FedEx have run into issues regarding contract employees.

That is why interns and drivers are now frequently being classified as employees instead of independent contractors. Additionally, the government is also requiring more businesses to have business liability and worker’s comp insurance, so the line is increasingly blurred.

Finally, it’s important to note that employers cannot choose whether their employees qualify as ICs or W2 employees. Employers can only choose how their candidates are treated, which may affect their classification – based on things like work flexibility, work from home, billable hours, etc. If you’re thinking about hiring a contractor, then speak with an attorney first! The Department of Labor is always changing the laws, primarily in response to our economic outlook. When the economy is struggling and employers take advantage of independent contractors, the DoL frequently requires full classification of employees.

Sorry, the comment form is closed at this time.